Introducing Card3000

A project by Ajay Alfred, Shawn Callegari, Mike Hotan, and Ravi Pinjala

Our modern world is plagued by an antiquated payment medium, the common credit card. An object that we are raised to use and depend on causes mass frustration in times of theft and malicious misuse. With the rise of mobile and ubiquitous computing, entrepreneurs around the world are looking to change the way we make in store payments.

Many of the implementations introduce a new interaction mechanisms. Some make the process of paying in stores incredibly simple. However, there is a set of challenges that restrains the expansion of these new platforms. First, consumers will always use what is comfortable and guaranteed to be available. People are creatures of habit. The credit card is almost an instinctual payment mechanism. In the small time span of a point of sale interaction, there is very minimal thought into which payments mechanism will be used. Second, companies will not change their payment infrastructure unless they see an immediate benefit. For the non technical merchant, there usually is no clearly visible benefit between more traditional card payment systems and the new ones.

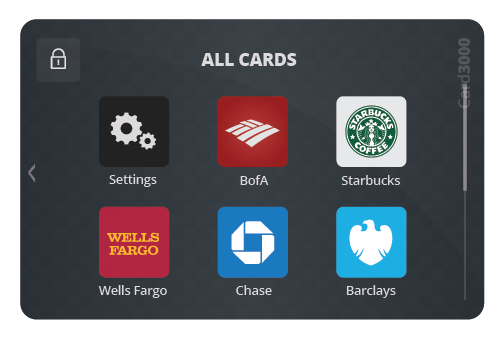

We propose a fresh take on a traditional interaction. With Card3000 consumers will continue to retain all the comfort of using a physical credit card but with the intelligence of a simple mobile computing device. With this device merchants will be able keep their current credit card infrastructure. Instead of many credit cards filling wallets and purses, one smart credit card can provide a more secure, friendlier way to pay.